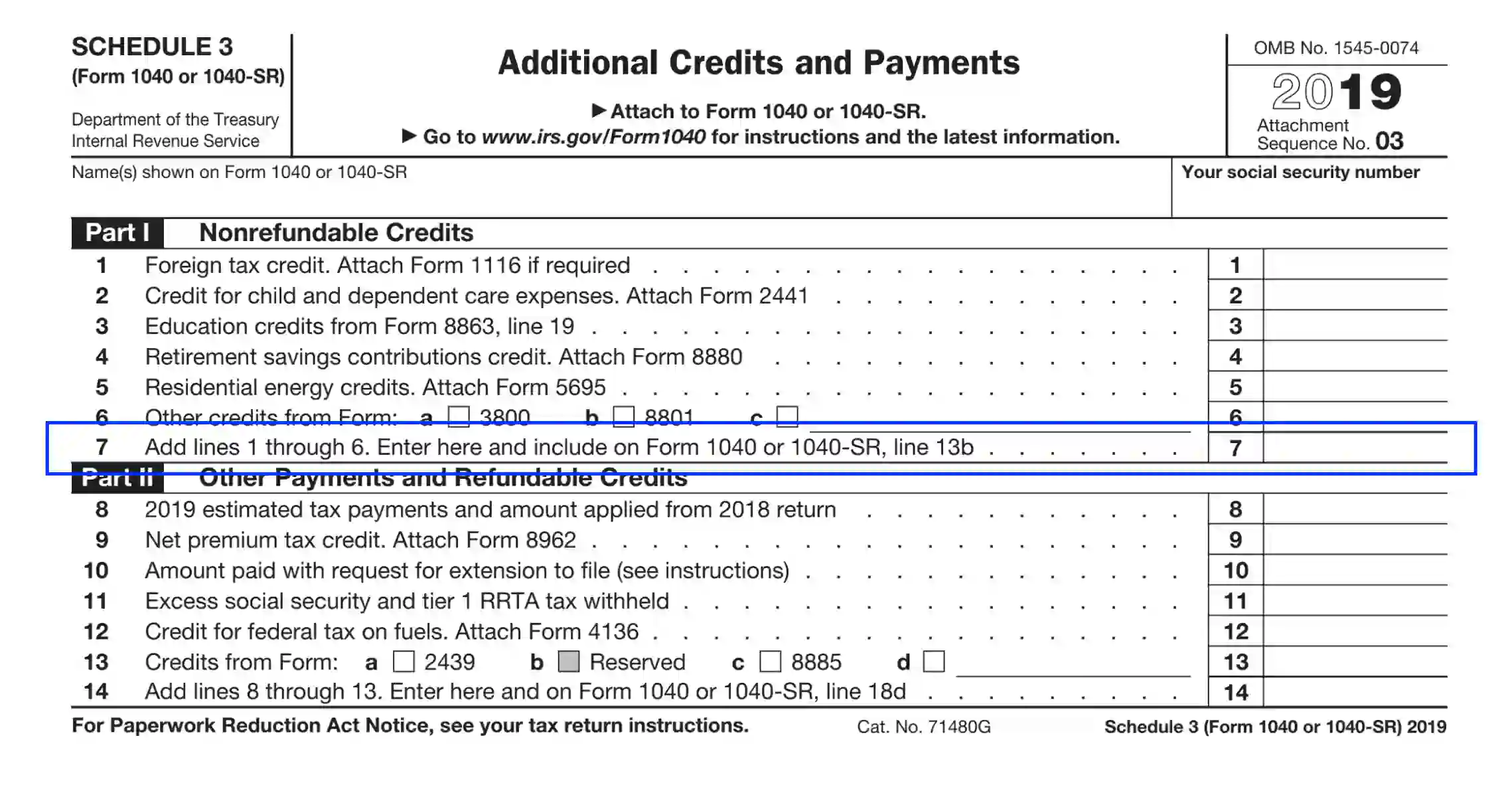

Irs form 1040 schedule 3

IRS Form 1040 Schedule 3: A Comprehensive Guide

Tax season can be a daunting time for many, with the myriad of forms and schedules to navigate. One such document that often raises questions is IRS Form 1040 Schedule 3. In this article, we will delve into the purpose, eligibility criteria, and detailed instructions for completing Schedule 3, ensuring you can tackle this part of your tax return with confidence.

I. Introduction

Understanding IRS Form 1040 Schedule 3 is crucial for accurate tax reporting. This schedule covers specific transactions that taxpayers need to report separately from their standard 1040 form. Let's explore why this form exists and its importance in the tax-filing process.

II. Purpose of IRS Form 1040 Schedule 3

Unlike the main 1040 form, Schedule 3 focuses on particular financial transactions that require separate reporting. This section will break down the purpose of Schedule 3 and highlight the types of transactions that fall under its purview.

III. Eligibility Criteria

Not everyone needs to complete Schedule 3, and there are exceptions based on individual circumstances. We will explore who should file this schedule and outline special cases where filing may not be necessary.

IV. Detailed Instructions for Schedule 3

Navigating tax forms can be confusing, but fear not! In this section, we will provide a step-by-step guide on completing Schedule 3, ensuring you don't miss any crucial details. We will also highlight common mistakes to avoid during the process.

V. Understanding Line Items

Breaking down the key line items on Schedule 3 is essential for accurate reporting. We'll provide detailed explanations of each line item, along with tips to ensure your information is reported correctly.

VI. Impact on Your Tax Liability

How does the information on Schedule 3 affect your overall tax situation? This section will explore the potential benefits and consequences of the transactions reported on this schedule.

VII. Frequently Asked Questions (FAQs)

Clearing up common queries about IRS Form 1040 Schedule 3 is crucial for understanding its intricacies. We'll provide detailed answers to frequently asked questions, offering clarity to taxpayers.

VIII. Tips for Efficiently Completing Schedule 3

Time-saving strategies can make tax season more manageable. In this section, we'll share tips for efficiently completing Schedule 3 and suggest resources for additional help if needed.

IX. Changes and Updates

Tax laws are subject to change, and Schedule 3 is no exception. We'll cover any recent modifications to the form, emphasizing the importance of staying informed about tax law changes.

X. Importance of Accurate Reporting

Accuracy in reporting is paramount to avoid complications with the IRS. This section will delve into the consequences of inaccuracies on Schedule 3 and provide tips for double-checking your information.

XI. Resources for Further Assistance

The IRS offers assistance for those navigating the complexities of tax forms. We'll guide you to the IRS helpline and online resources, and discuss when seeking professional help may be necessary.

XII. Real-Life Scenarios

To bring clarity to the theoretical, we'll provide real-life examples illustrating when Schedule 3 is necessary. Learning from others' experiences can help you navigate your own tax situation more confidently.

XIII. Planning for Next Tax Season

Tax planning is a year-round endeavor. We'll outline steps to prepare for Schedule 3 in future filings and offer tips on staying organized for a more efficient tax season.

XIV. Conclusion

In conclusion, understanding and accurately completing IRS Form 1040 Schedule 3 is crucial for a stress-free tax season. By following our comprehensive guide, you'll be better equipped to handle this aspect of your tax return with confidence.

XV. Unique FAQs

Can I file Schedule 3 electronically?

Absolutely! The IRS encourages electronic filing for all forms, including Schedule 3. Utilizing e-file options can expedite the processing of your tax return.

What happens if I forget to include a transaction on Schedule 3?

If you realize you omitted a transaction, it's essential to file an amended return promptly. Failure to do so could result in penalties or interest on the unreported amount.

Are there income limits for filing Schedule 3?

Schedule 3 doesn't have specific income limits, but eligibility is based on the types of transactions you engaged in during the tax year.

Can I use tax software to complete Schedule 3?

Yes, most tax software programs guide you through the process of completing Schedule 3. Ensure your chosen software supports this form.

How long should I keep records of transactions reported on Schedule 3?

It's advisable to keep records for at least three years after filing your tax return. These records serve as proof in case of an audit.

Comments

Post a Comment