2023 schedule a instructions

Introduction to 2023 Schedule A Instructions

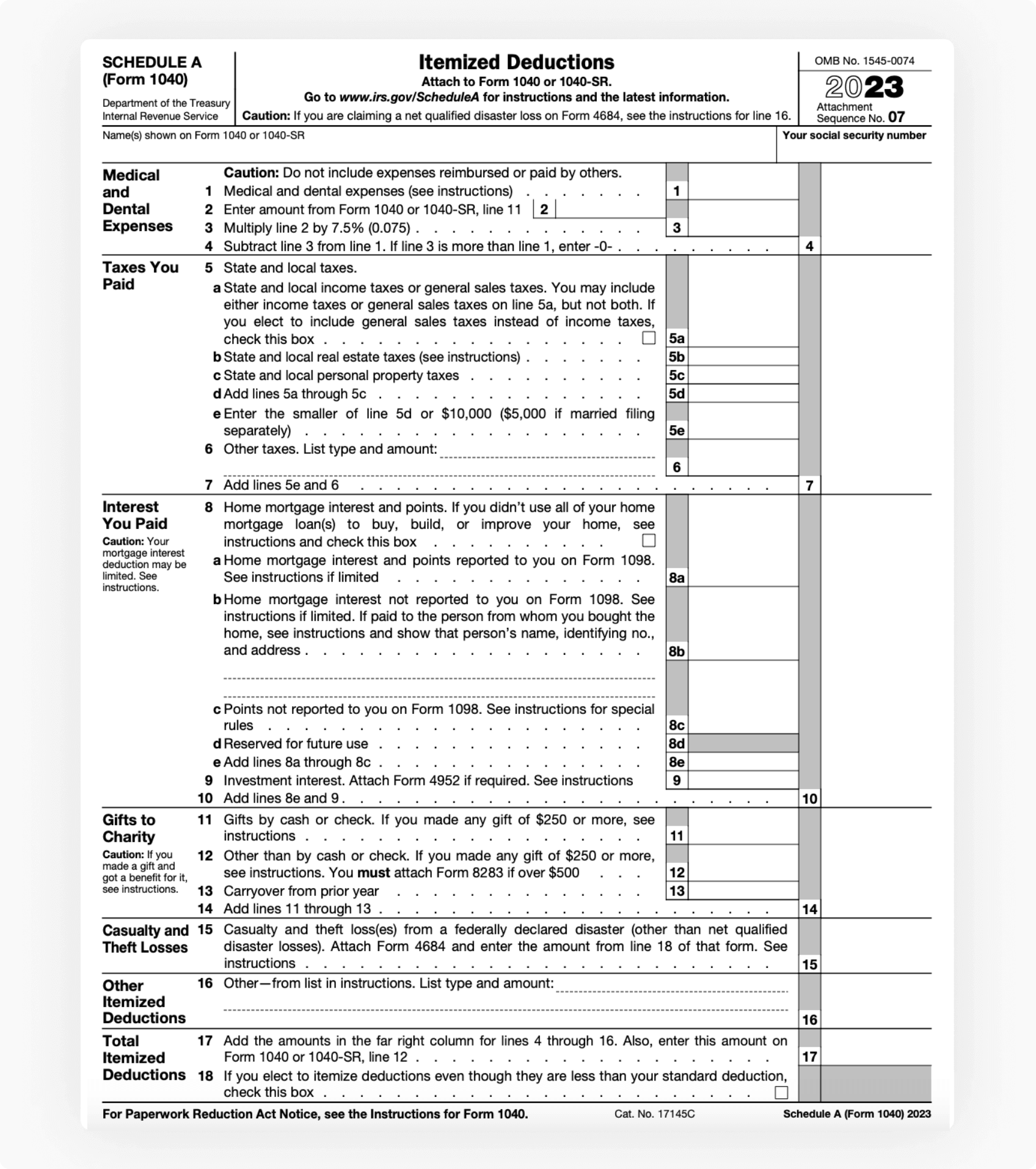

The tax season is upon us, and for many taxpayers, navigating the complex landscape of IRS forms can be a daunting task. One such crucial form is Schedule A, which details itemized deductions. In this article, we'll delve into the 2023 Schedule A Instructions, exploring its significance and key changes that individuals need to be aware of.

Importance of Following IRS Guidelines

Adhering to IRS guidelines is paramount for a smooth tax-filing experience. The Schedule A form provides a structured way to report various expenses, ensuring compliance with tax laws. Failure to follow these instructions could lead to errors in your tax return, potentially resulting in penalties or delays in refunds.

Key Changes in the 2023 Schedule A Instructions

3.1 Detailed breakdown of income categories

The 2023 instructions offer a comprehensive breakdown of income categories, making it easier for taxpayers to accurately report their earnings. Understanding these categories is crucial for correct classification and ensures that you take advantage of every eligible deduction.

3.2 New deductions and credits

The IRS regularly updates deductions and credits to reflect changes in tax laws. Familiarizing yourself with these new additions can lead to substantial savings. We'll explore these in detail to help you make the most of available benefits.

Understanding the Filing Process

4.1 Eligibility criteria

Before diving into the Schedule A form, it's essential to determine if you qualify for itemized deductions. We'll outline the eligibility criteria, ensuring you don't waste time on a form that may not be applicable to your situation.

4.2 Common mistakes to avoid

Avoiding common pitfalls in the filing process is crucial. Learn from others' mistakes as we highlight errors often made when completing Schedule A, empowering you to submit an accurate and error-free tax return.

Step-by-Step Guide to Completing Schedule A

5.1 Gathering necessary documents

To successfully complete Schedule A, you need to gather specific documents to support your deductions. We'll guide you through the documents required, streamlining the preparation process.

5.2 Entering income details

Accurate reporting of income is a cornerstone of the tax-filing process. We'll break down the steps for entering your income details correctly, ensuring your tax return reflects your financial reality.

5.3 Utilizing available deductions

The heart of Schedule A lies in its deductions. Learn how to navigate this section efficiently, maximizing your deductions and potentially reducing your taxable income.

Tips for Optimizing Your Tax Return

6.1 Maximizing eligible deductions

Discover strategies for maximizing your eligible deductions, potentially increasing your tax refund or minimizing your tax liability. Every dollar saved counts, and we'll show you how.

6.2 Strategies for reducing taxable income

Beyond deductions, there are additional strategies for reducing your taxable income. From tax credits to adjustments, we'll explore ways to optimize your financial situation within the confines of IRS regulations.

Common FAQs about Schedule A Instructions

7.1 Who should use Schedule A?

Understanding whether Schedule A is the right form for you is crucial. We'll address common scenarios where individuals benefit most from itemizing deductions.

7.2 What are the deadlines for filing?

Timely filing is essential to avoid penalties. We'll clarify the deadlines associated with Schedule A, ensuring you submit your tax return within the prescribed timeframe.

7.3 How to rectify errors on Schedule A?

Mistakes happen. We'll guide you on the steps to rectify errors on your Schedule A, providing peace of mind during the tax-filing process.

Importance of Staying Informed

8.1 Annual updates and changes

Tax laws evolve, and staying informed is key to navigating these changes successfully. We'll highlight the importance of keeping up with annual updates to ensure accurate and compliant tax filing.

8.2 Resources for additional support

For those seeking additional support, we'll provide resources where you can find help. Whether it's online tools or professional advice, being aware of available resources enhances your confidence in the tax-filing process.

Conclusion

As you embark on the journey of completing your 2023 tax return, understanding the Schedule A instructions is pivotal. Following these guidelines meticulously ensures a hassle-free filing experience, potentially leading to financial benefits through maximized deductions and credits.

FAQs

10.1 What are the penalties for incorrect filing?

Incorrect filing can result in penalties. The severity depends on the nature of the error. It's crucial to review your tax return thoroughly to avoid such consequences.

10.2 Can I amend my Schedule A after submission?

Yes, you can amend your Schedule A if you discover errors or omitted information. The IRS provides a process for filing an amended return to rectify mistakes.

10.3 Is there a limit to the deductions I can claim?

While there's no strict limit on the deductions you can claim, certain categories may have restrictions. Understanding these limitations ensures accurate reporting.

10.4 How does Schedule A affect my overall tax liability?

Schedule A can impact your overall tax liability by reducing your taxable income through deductions. This, in turn, may lower the amount of taxes you owe or increase your tax refund.

10.5 Are there specific requirements for itemizing deductions?

Itemizing deductions is optional, but certain conditions must be met to make it advantageous. Consider factors such as eligible expenses and the potential for a higher deduction amount compared to the standard deduction.

Comments

Post a Comment